Trading futures options is a potentially 해외선물 profitable way to make use of the financial markets but comes with its reasonable share of threats. At their core, margin requirements function as investment security that must be met when entering into any kind of position on this market – and they’re something essential to comprehend if you want to gain these incentives without substantial losses. In our article today, we explain margins in even more information so financiers can get up-to-speed promptly and successfully!

What Are Margin Requirements?

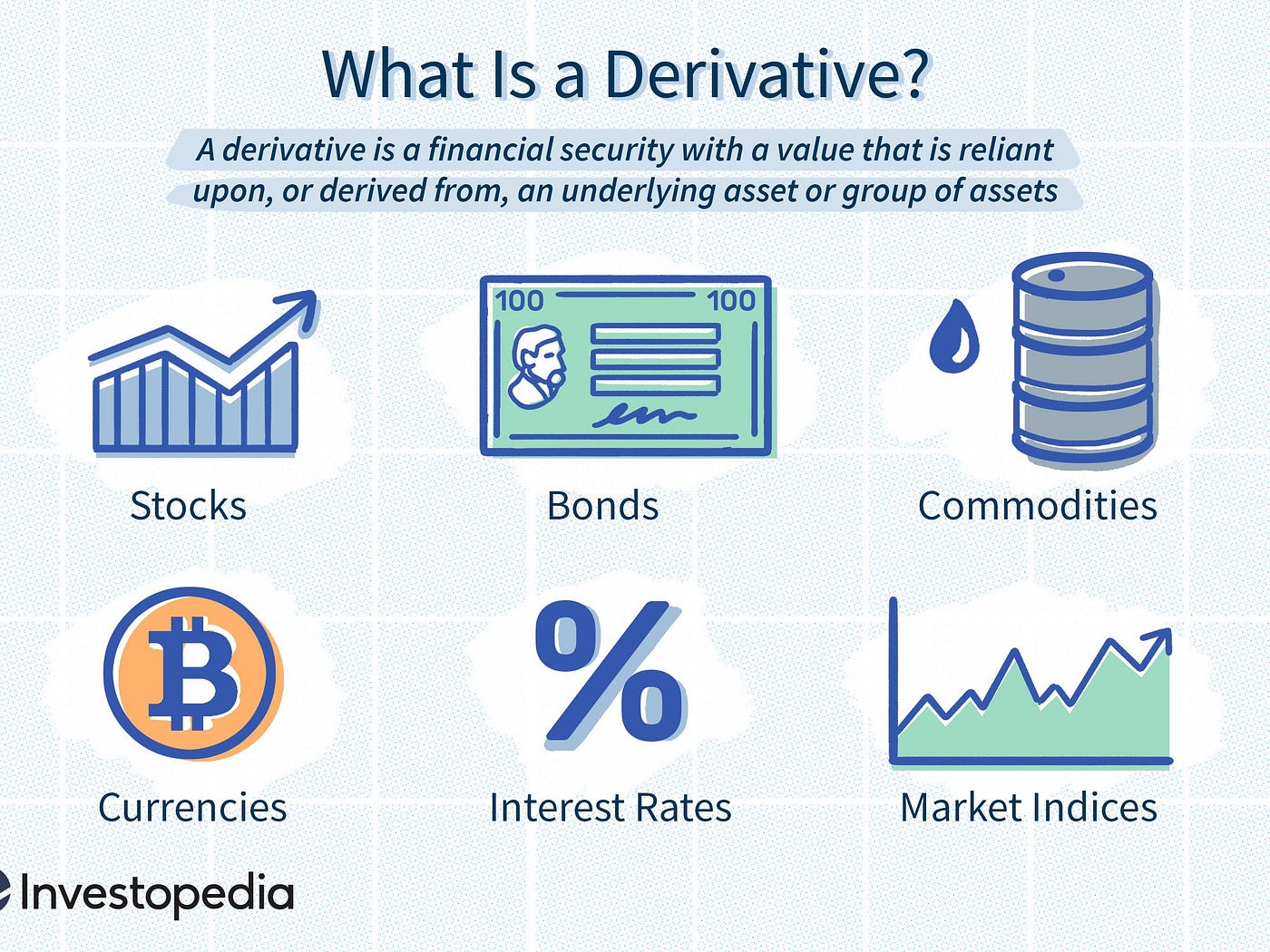

Margin requirements are 선물옵션 the amount of money that you require to deposit with your broker to open a futures alternatives position. Futures choices are acquired instruments that allow traders to buy or offer an underlying property at a future day as well as cost. Because they are leveraged instruments, 해외선물커뮤니티 investors can regulate a much more considerable quantity of the underlying possession with a reasonably small amount of money.

To make certain safety, investors setting up futures alternatives agreements have to meet margin demands – an amount of security deposited with their broker to hedge versus any kind of prospective losses. These estimations are based on the agreement type and underlying asset’s value along with each private broker’s plans and also they generally take the kind of percentage-based terms.

How Do Margin Demands Work?

Margin needs serve as safeguards for brokers to limit losses must an investor’s placement change unfavorably. For instance, if an individual wish to buy a futures alternatives 해외선물대여계좌 agreement at $10,000 and also the margin requirement is 10%, they will certainly require to put down only $1,000 with their broker in order to satisfy that obligation.

Trading on margin provides the prospect to capitalize on market activities, yet it can likewise be a risky undertaking. If possession worths decrease as well as losses surpass your initial down payment, brokers can release a warning; added funds are needed in order to stabilize any kind of deficits incurred by traders.

With the ever-changing characteristics of markets, it is necessary to stay educated in order to make sure you have enough margin down payment for your broker. High volatility degrees may require more from investors than low volatility durations; therefore market problems can directly influence margin demands. Understanding these transforming fads as well as remaining on top of them is essential.

Why Are Margin Demands Essential?

Margin needs are a vital factor 해선대여계좌 in assisting traders minimize their risks. Brokers call for deposits to see to it that financiers will not overextend, securing both them as well as the broker versus prospective losses.

Final thought

Margin requirements play an important duty in the wellness of financial markets, preventing supposition from running rampant. By managing how much a trader can utilize properties with percentages of resources, margin needs aid maintain volatility and instability away.